We are excited to share that BlockEden.xyz is joining hands with Stellar, in order to empower developers worldwide. Stellar's blockchain platform has been a game-changer in quick and affordable cross-border transactions, while BlockEden.xyz's reliable API offerings for diverse DApps have positioned us as a key player across multiple blockchains. Together, we are poised to inspire a dynamic shift in the realms of blockchain and global finance.

What is Stellar

Stellar is an open-source, decentralized blockchain network designed to facilitate swift, low-cost cross-border transactions. Introduced in 2014 by Jed McCaleb, co-founder of Ripple and eDonkey, the Stellar network operates on a unique consensus protocol rather than the traditional proof-of-work or proof-of-stake mechanisms. People use Stellar network to build applications, issue assets, and build anchors (currency converters).

Stellar Soroban

Soroban is a smart contract platform that is integrated into the existing Stellar blockchain. Developers could develop smart contracts with a Rust dialect and interact with Stellar’s accounts and assets, not other operations like SDEX, AMMs, Claimable Balances, or Sponsorships.

The Soroban mainnet upgrade is scheduled for February 20th .

What is BlockEden.xyz

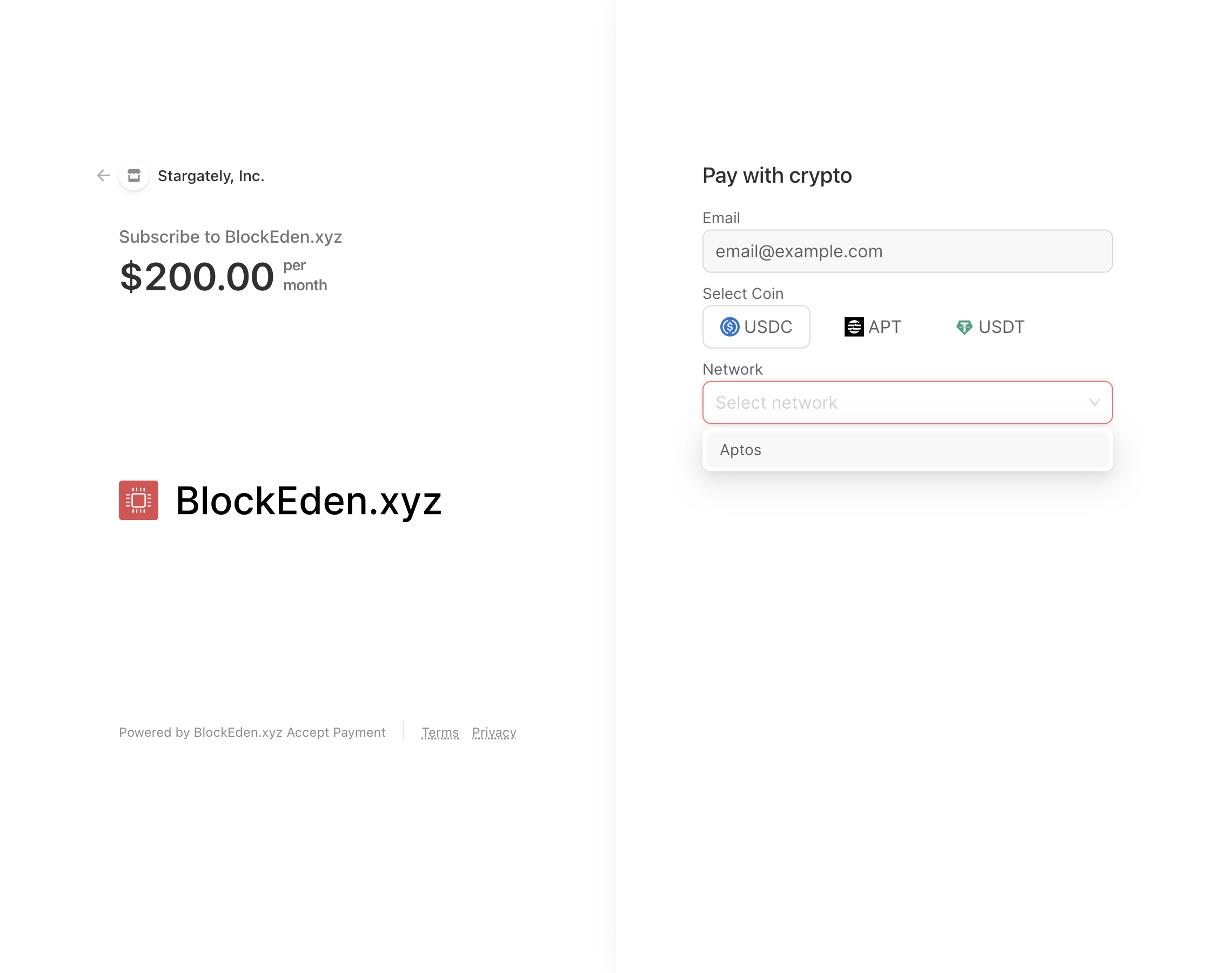

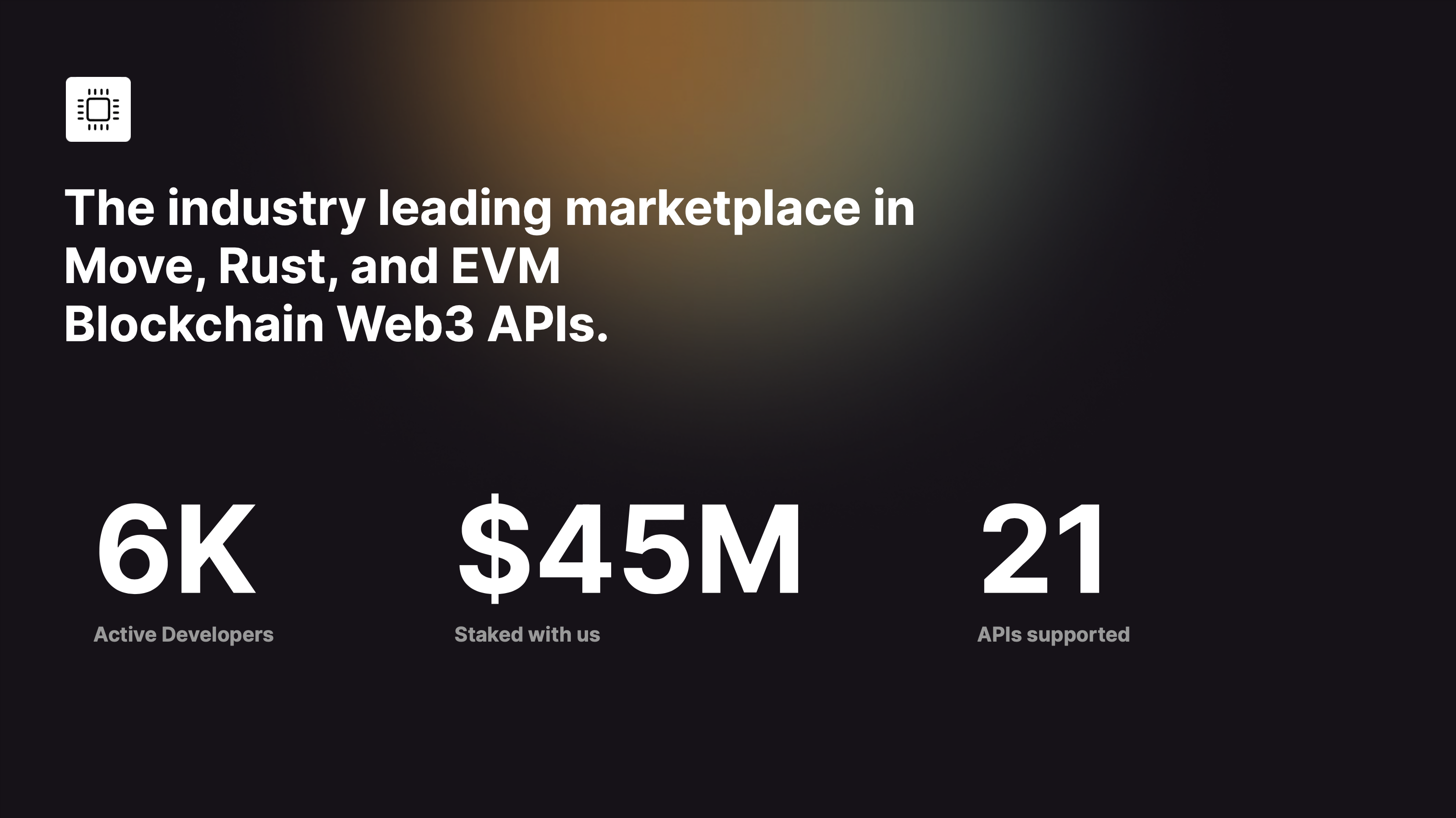

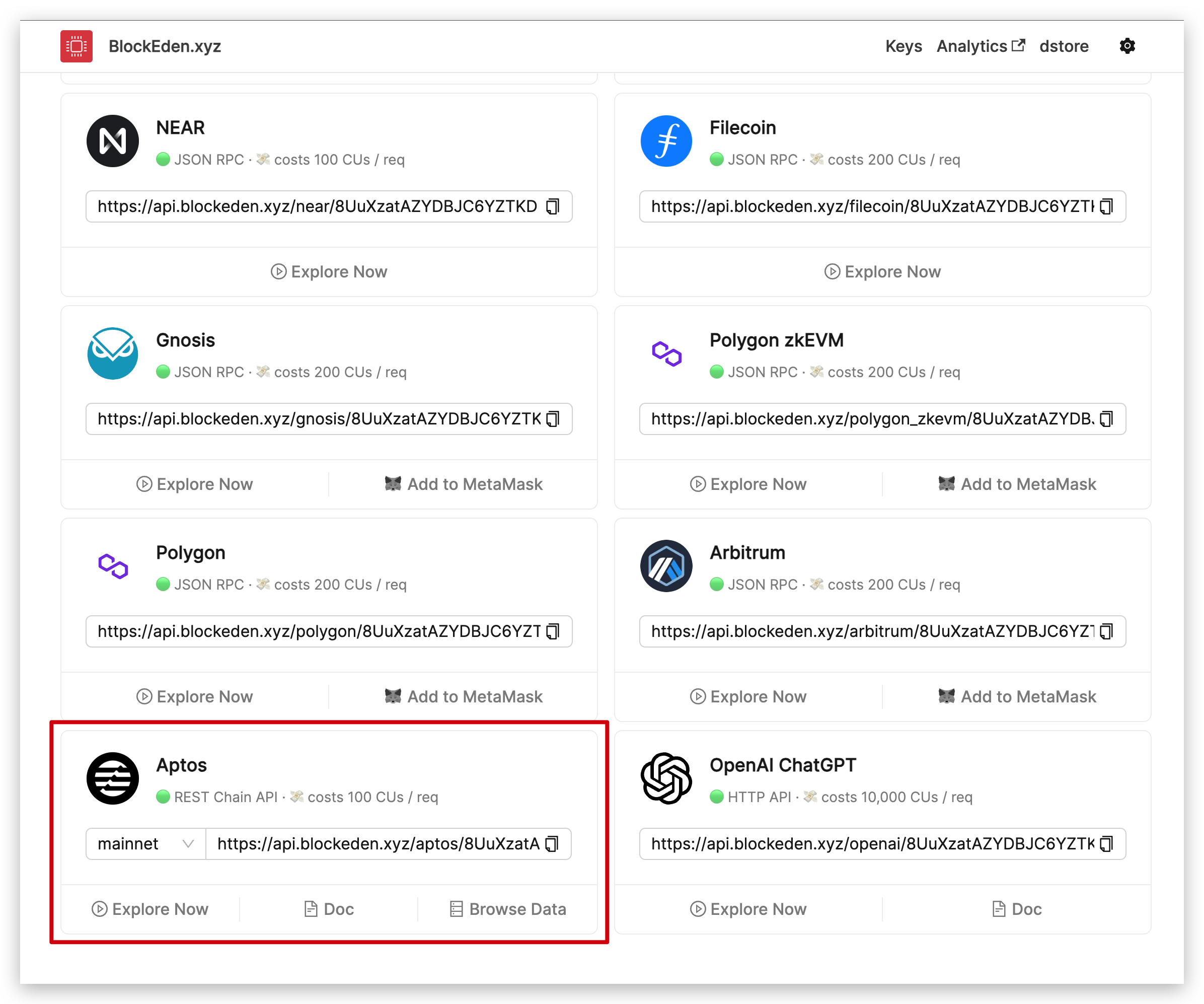

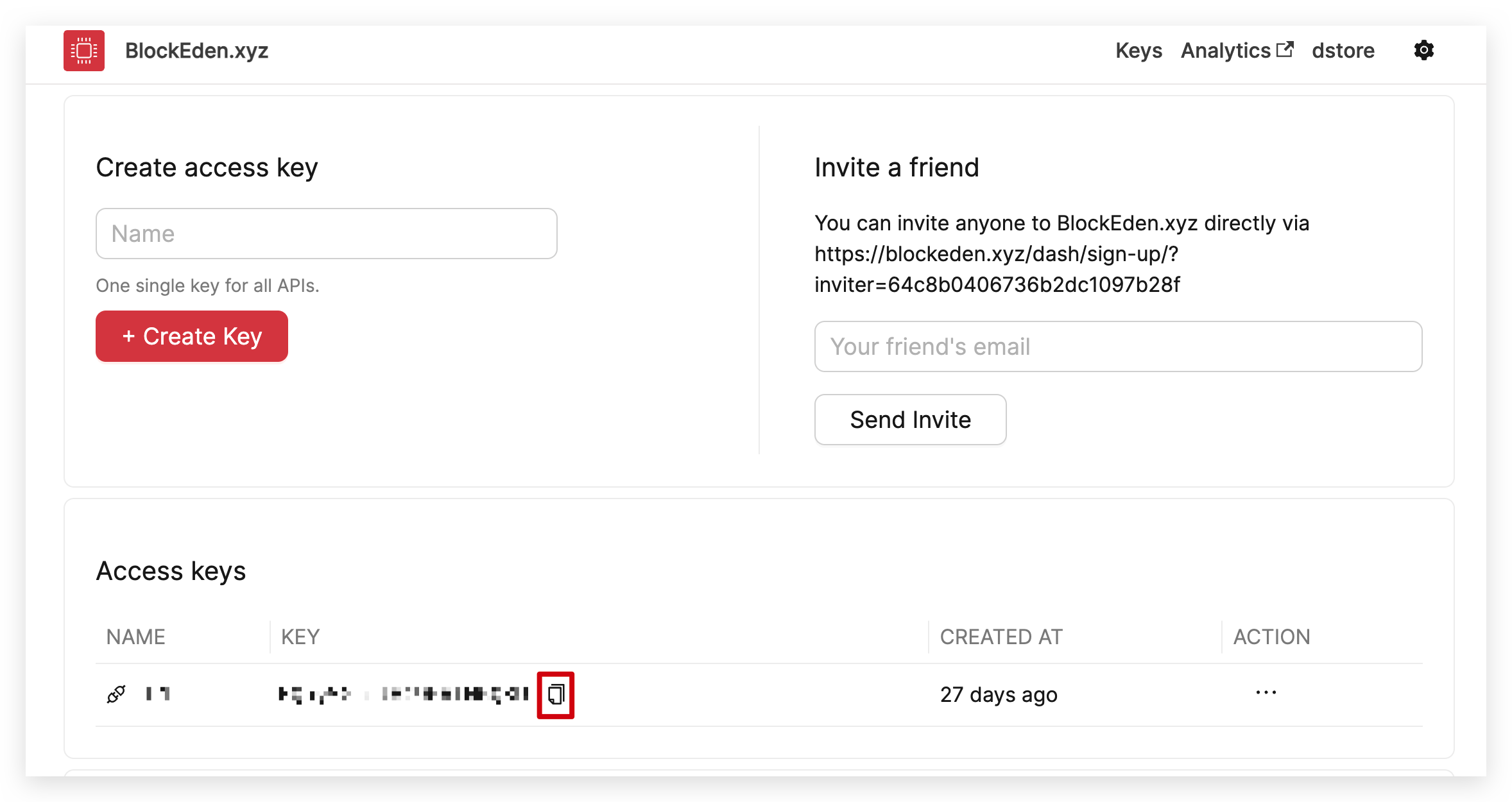

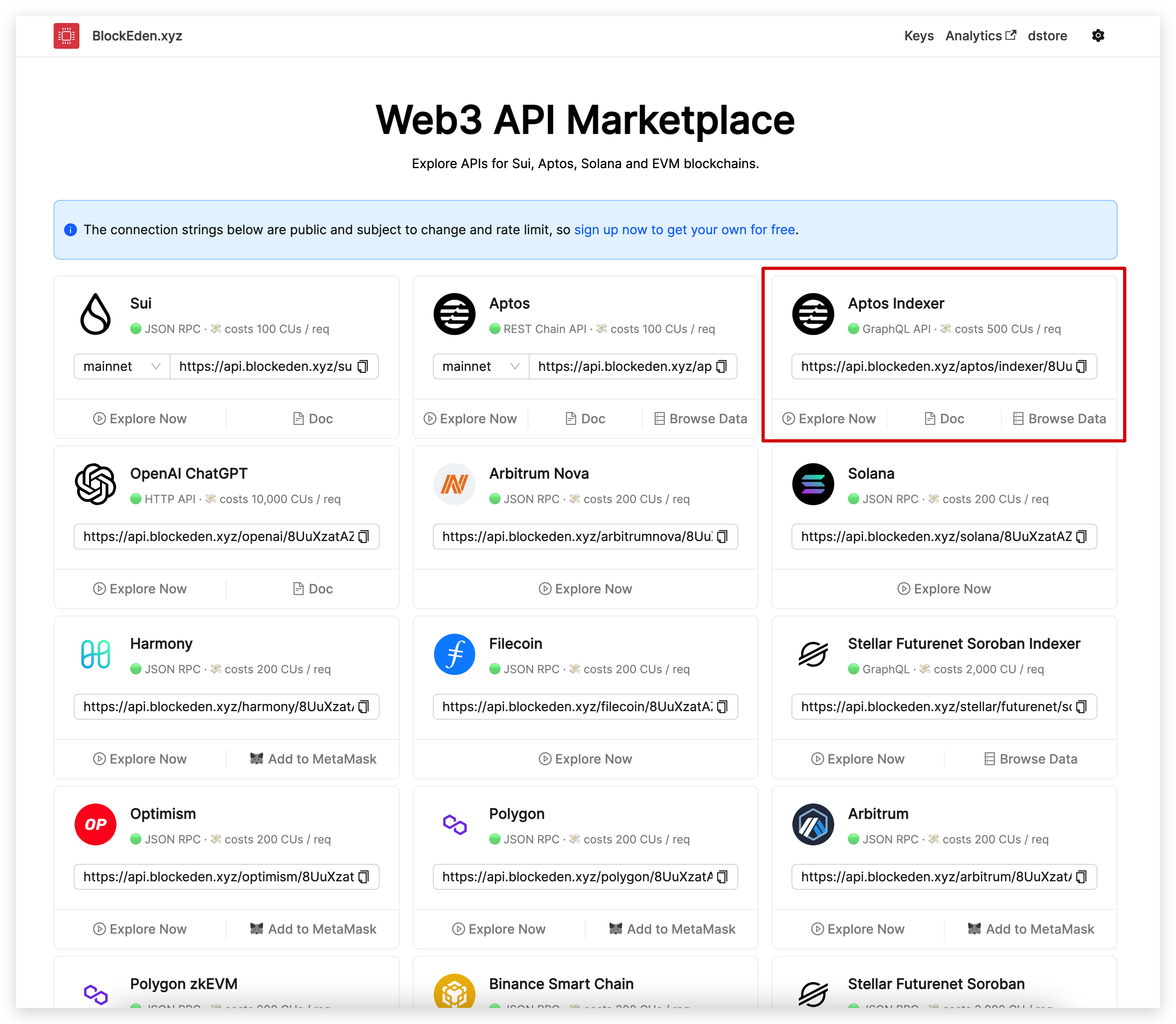

BlockEden.xyz is an API marketplace powering DApps of all sizes for Sui, Aptos, Solana, and 12 EVM blockchains. Why do our customers choose us?

- High availability. We maintain 99.9% uptime since our first API - Aptos main net launch.

- Inclusive API offerings and community. Our services have expanded to include Sui, Ethereum, IoTeX, Solana, Polygon, Polygon zkEVM, Filecoin, Harmony, BSC, Arbitrum, Optimism, Gnosis, Arbitrum Nova & EthStorage Galileo. Our community 10x.pub has 4000+ web3 innovators from Silicon Valley, Seattle, and NYC.

- Security. With over $45 million worth of tokens staked with us, our clients trust us to provide reliable and secure solutions for their web3 and blockchain needs.

We provide a comprehensive suite of services designed to empower every participant in the blockchain space, focusing on three key areas:

- For blockchain protocol builders, we ensure robust security and decentralization by operating nodes and making long-term ecosystem contributions.

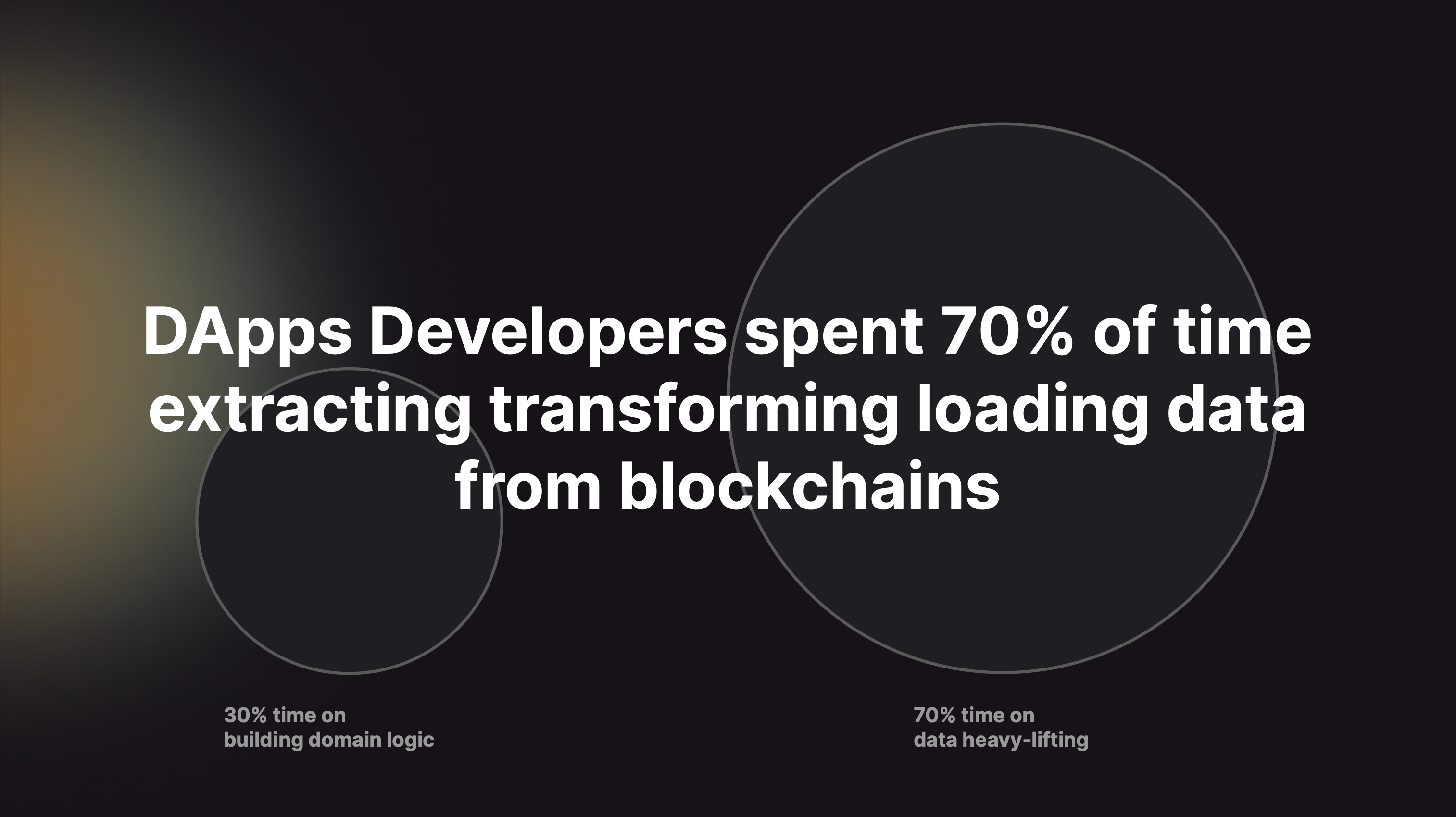

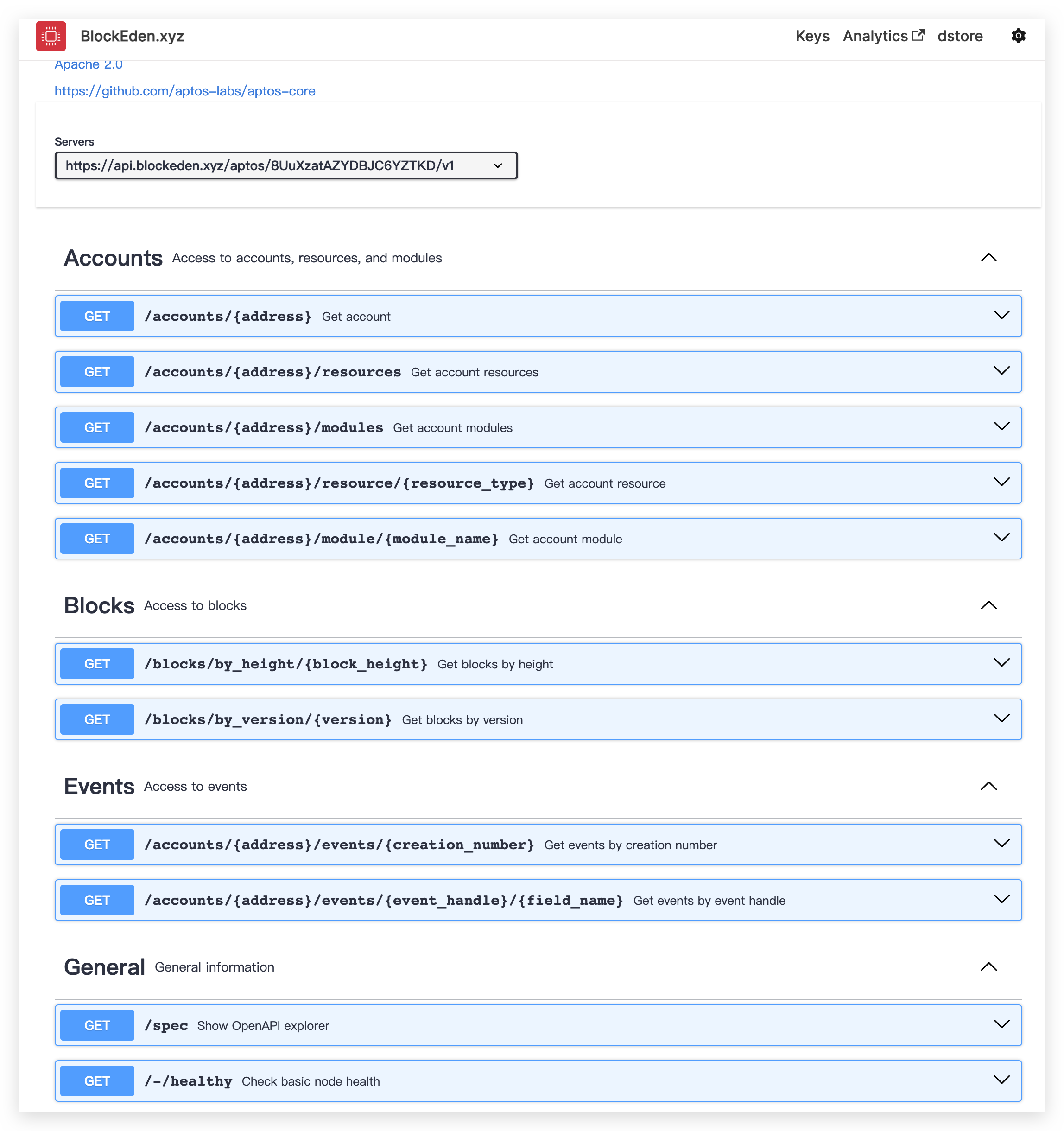

- For DApp developers, we build user-friendly APIs to streamline development and unleash the full potential of decentralized applications.

- For token holders, we offer a reliable staking service to maximize rewards and optimize asset management.

What is BlockEden.xyz building on Stellar and what does this mean for developers?

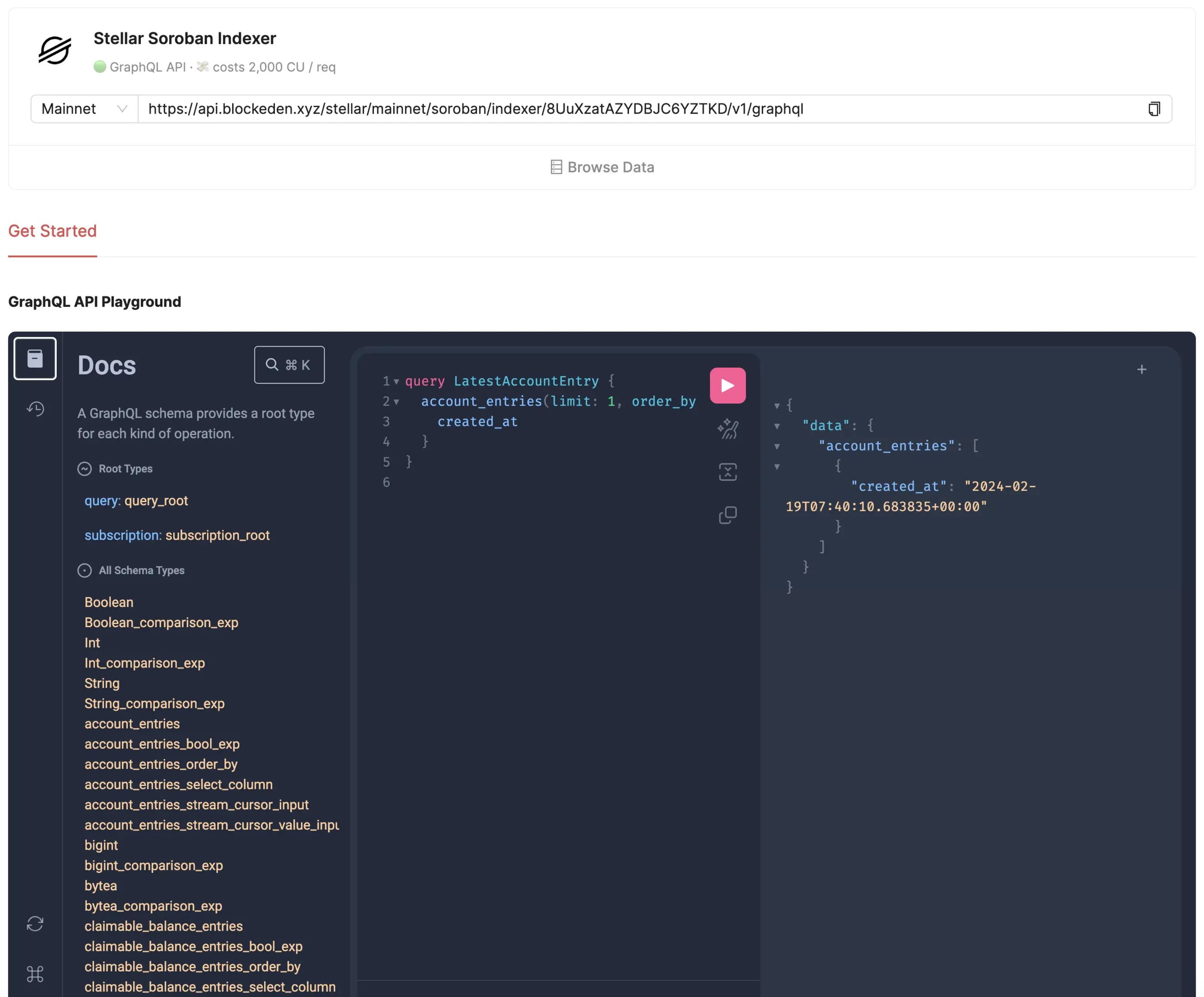

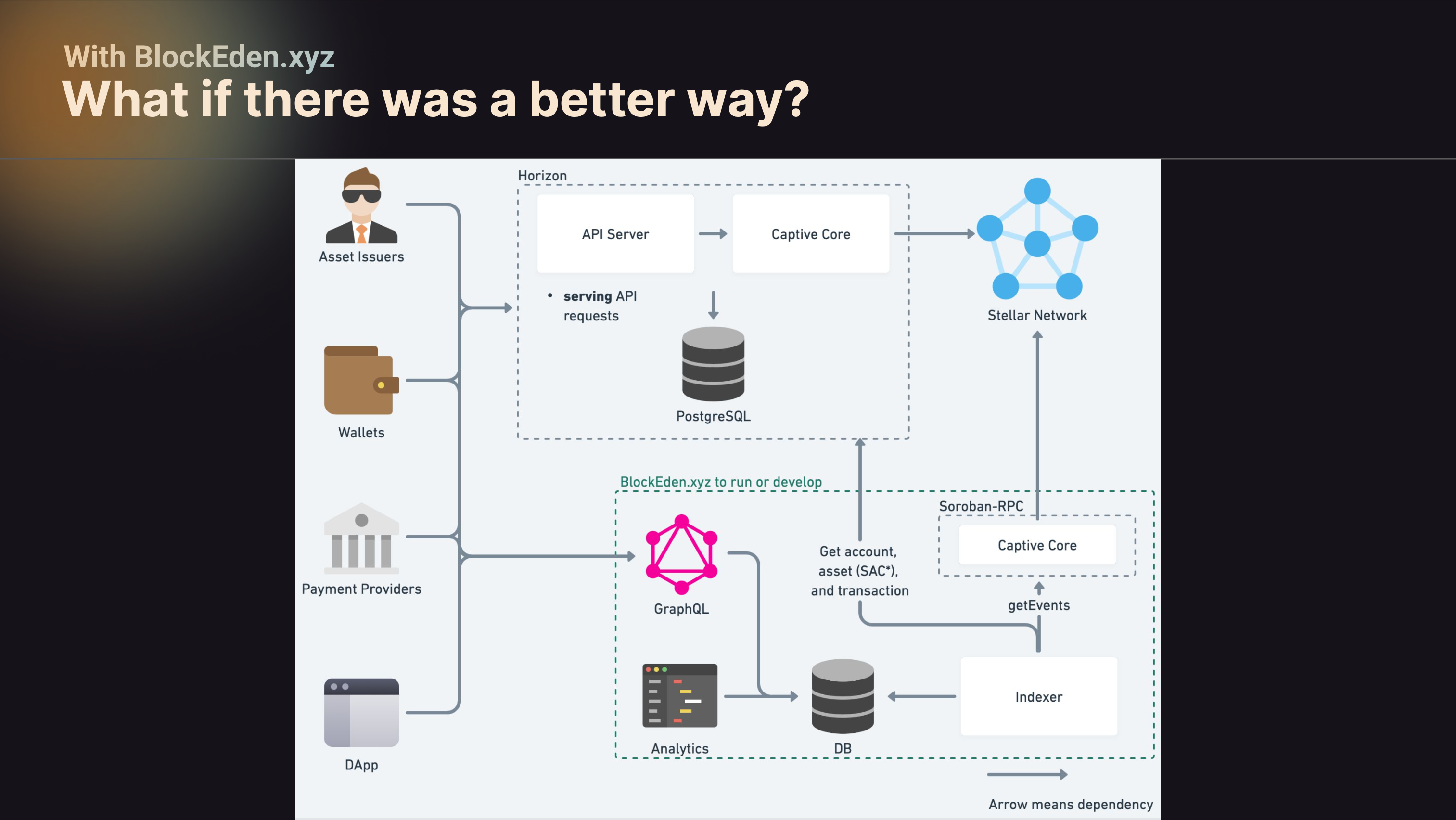

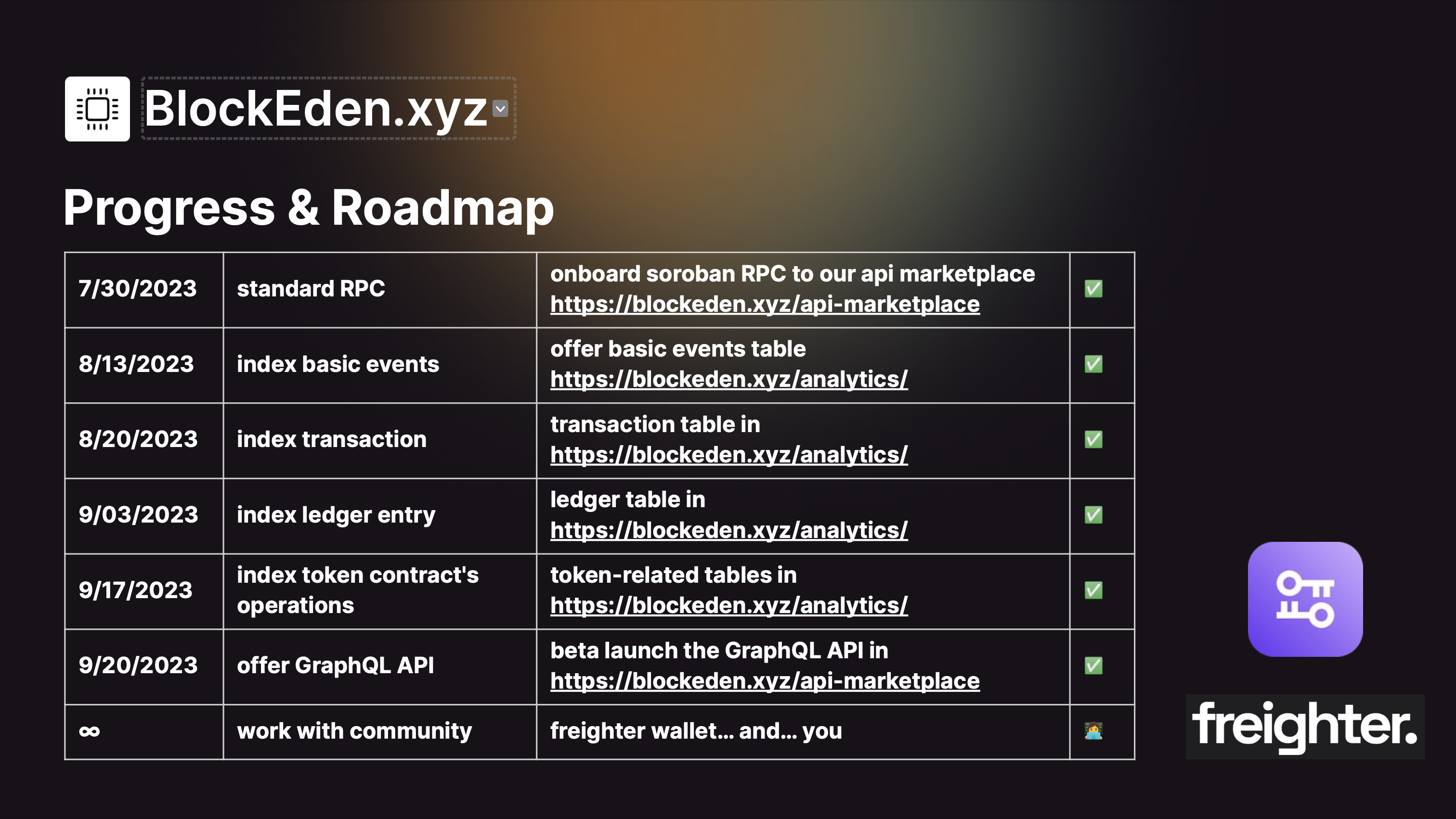

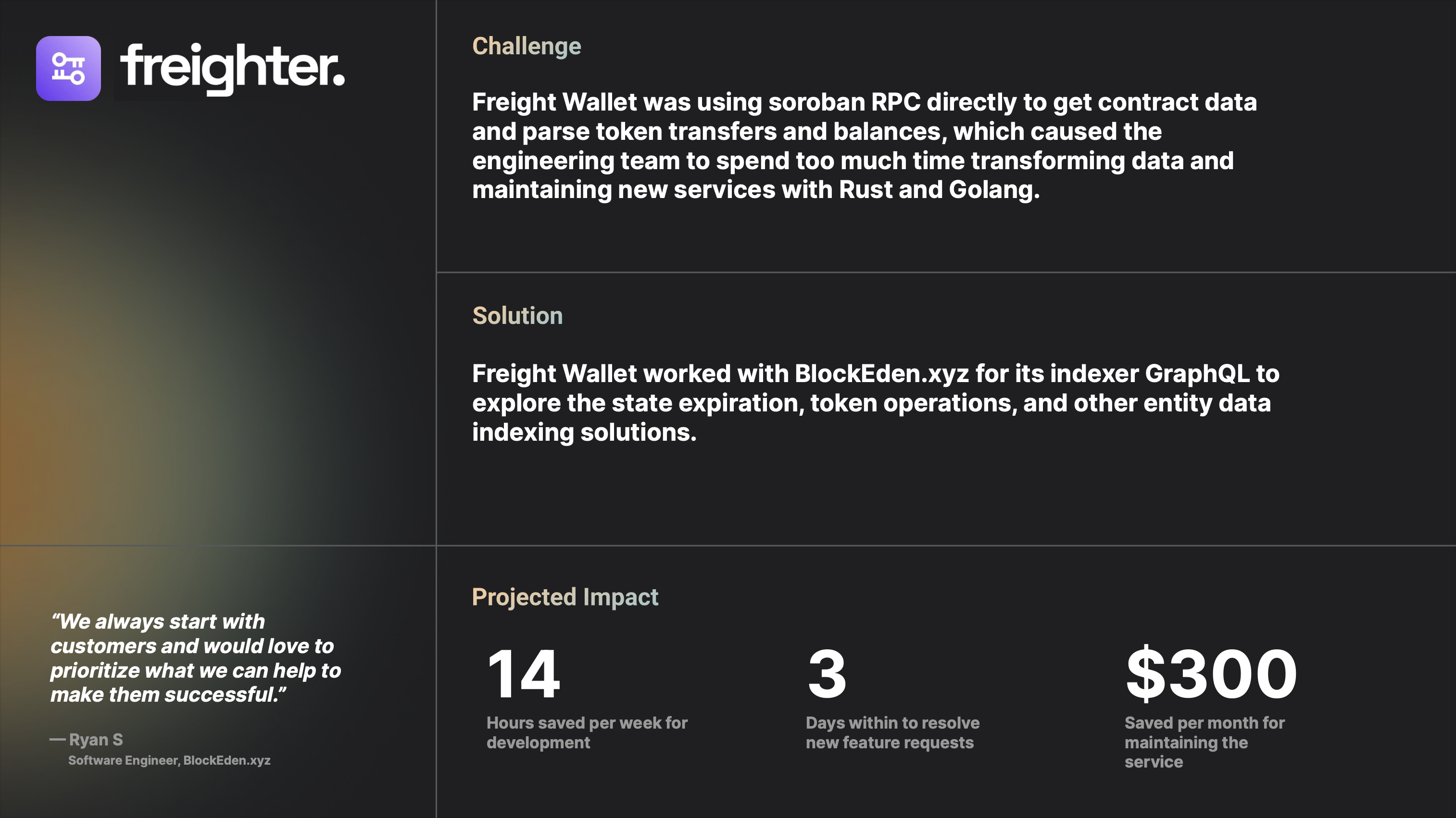

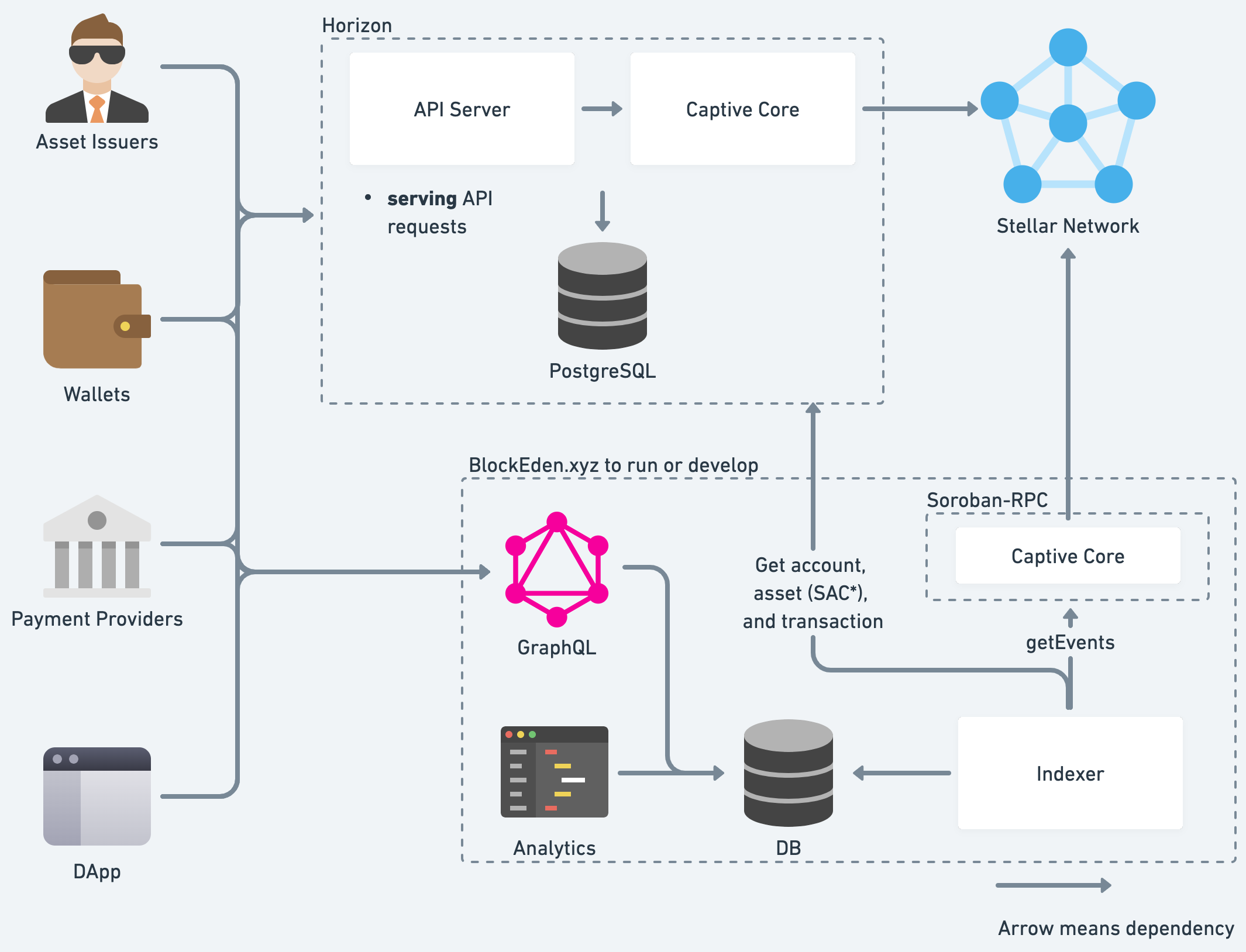

BlockEden.xyz is leveraging the Stellar network to offer commercial Soroban RPC and indexed data to help DApp developers to speed up development with a GraphQL API and analytics.

This comprehensive expansion into Stellar's infrastructure is set to present developers with more resources and tools, potentially facilitating easier adoption and more robust application development within the Stellar blockchain ecosystem.

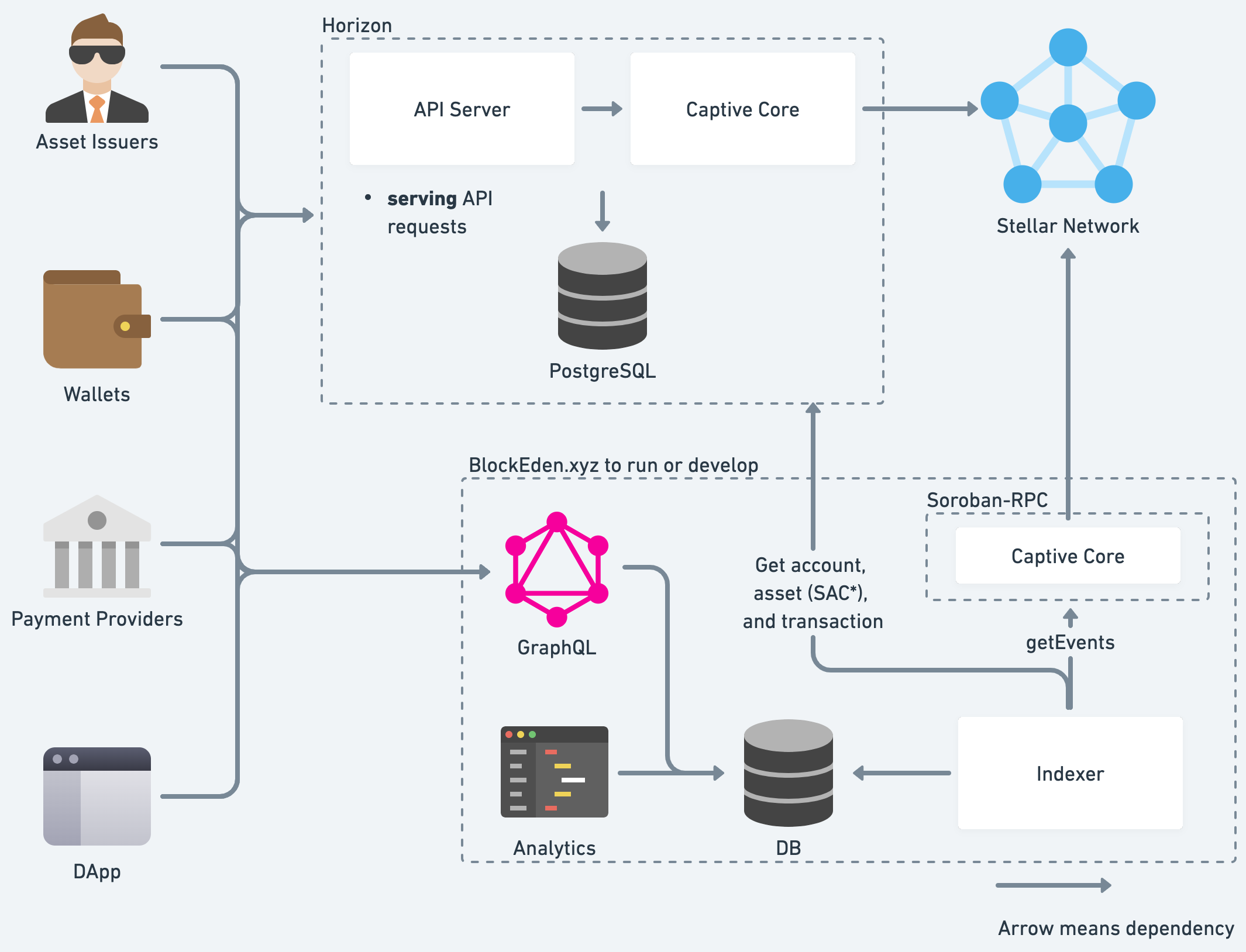

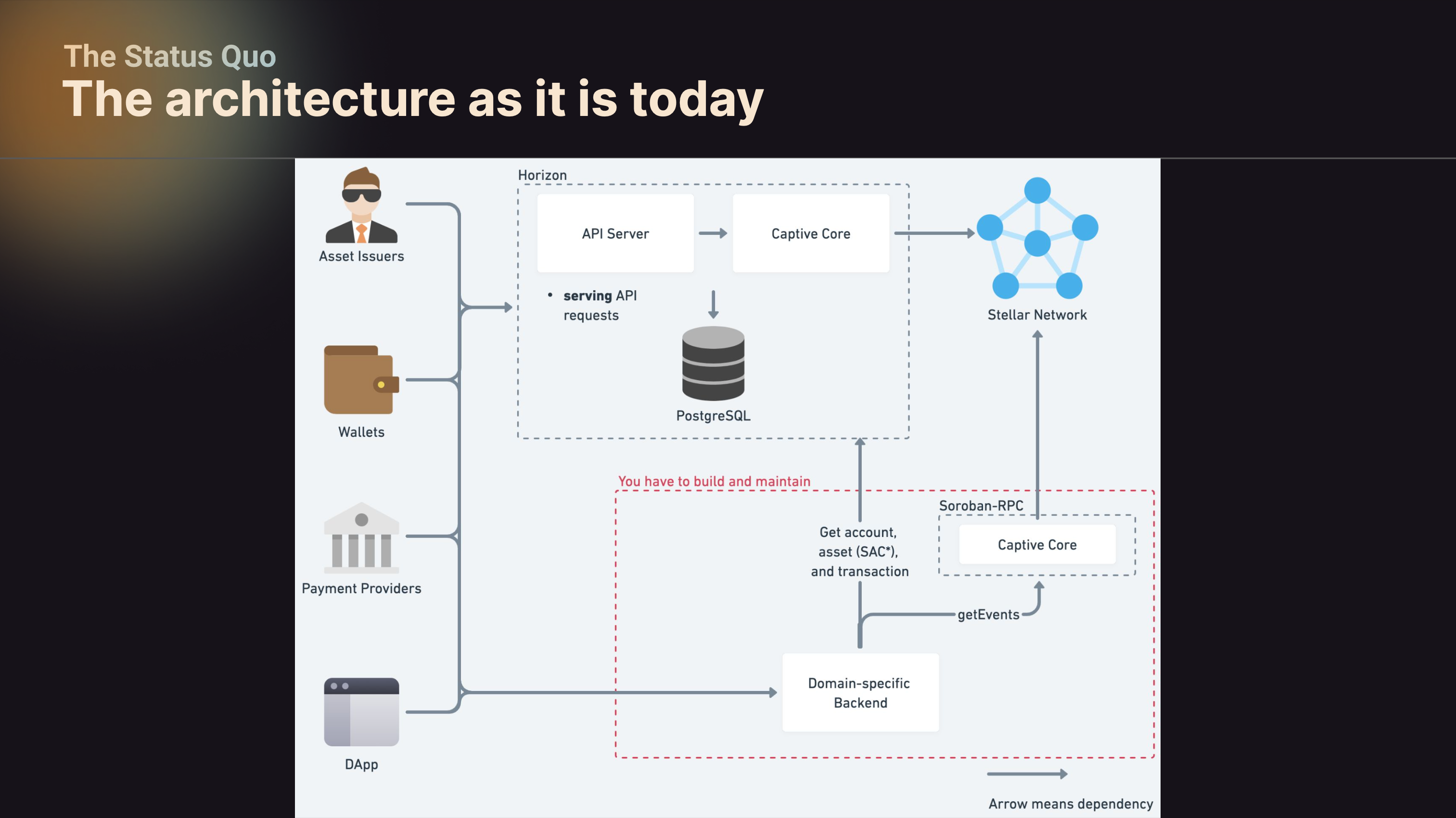

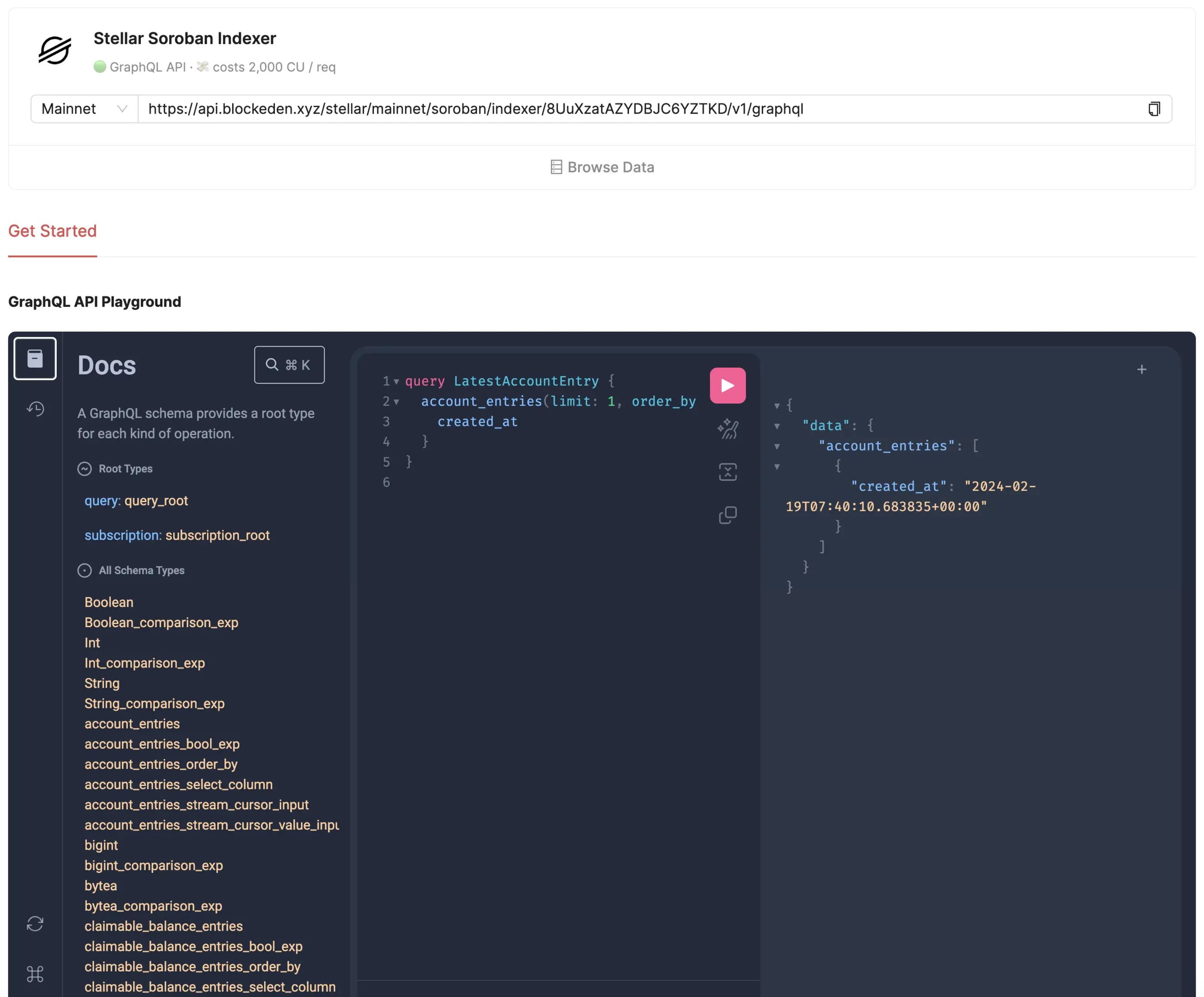

Node operator and Indexer for Soroban RPC and Indexer GraphQL

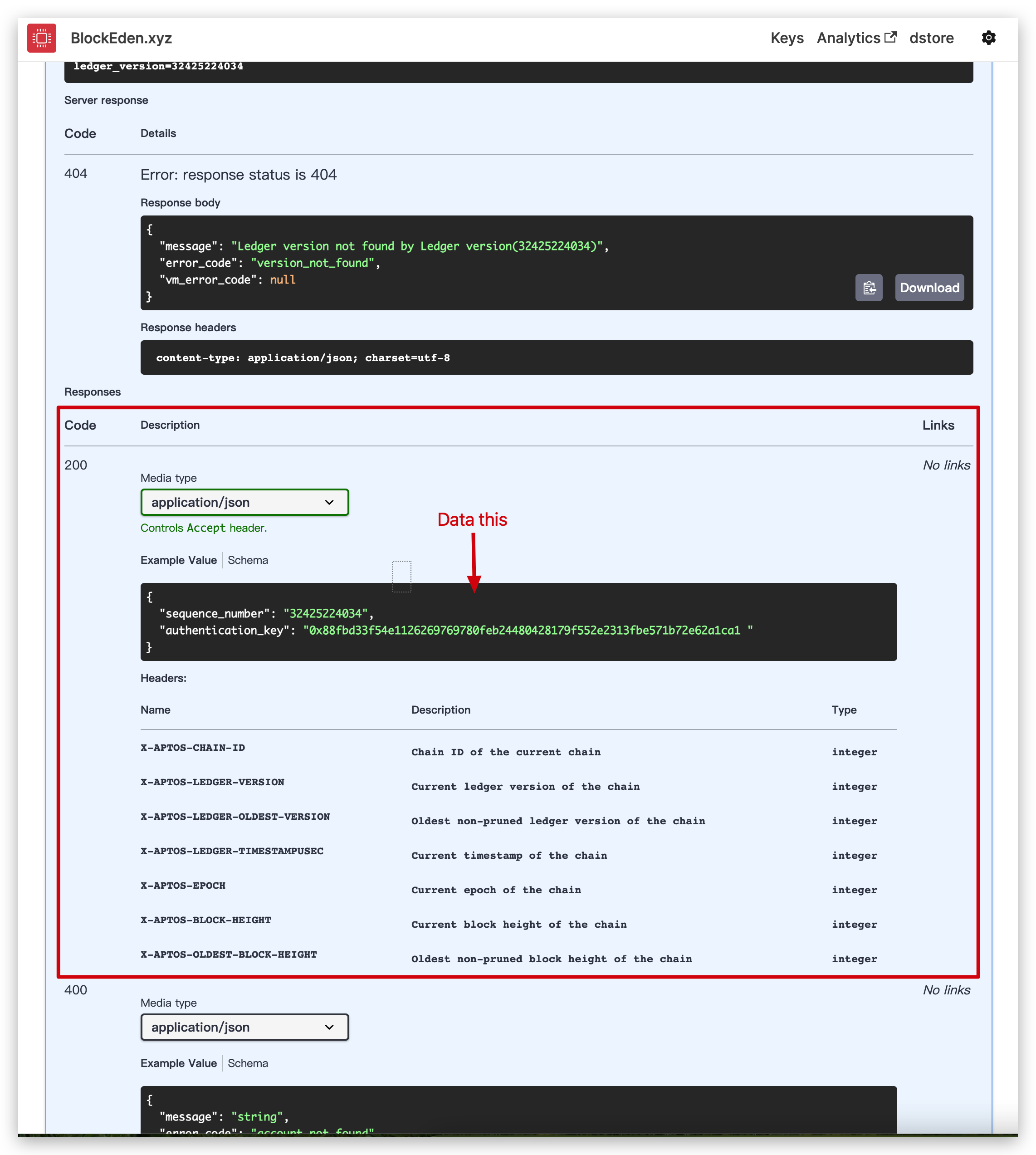

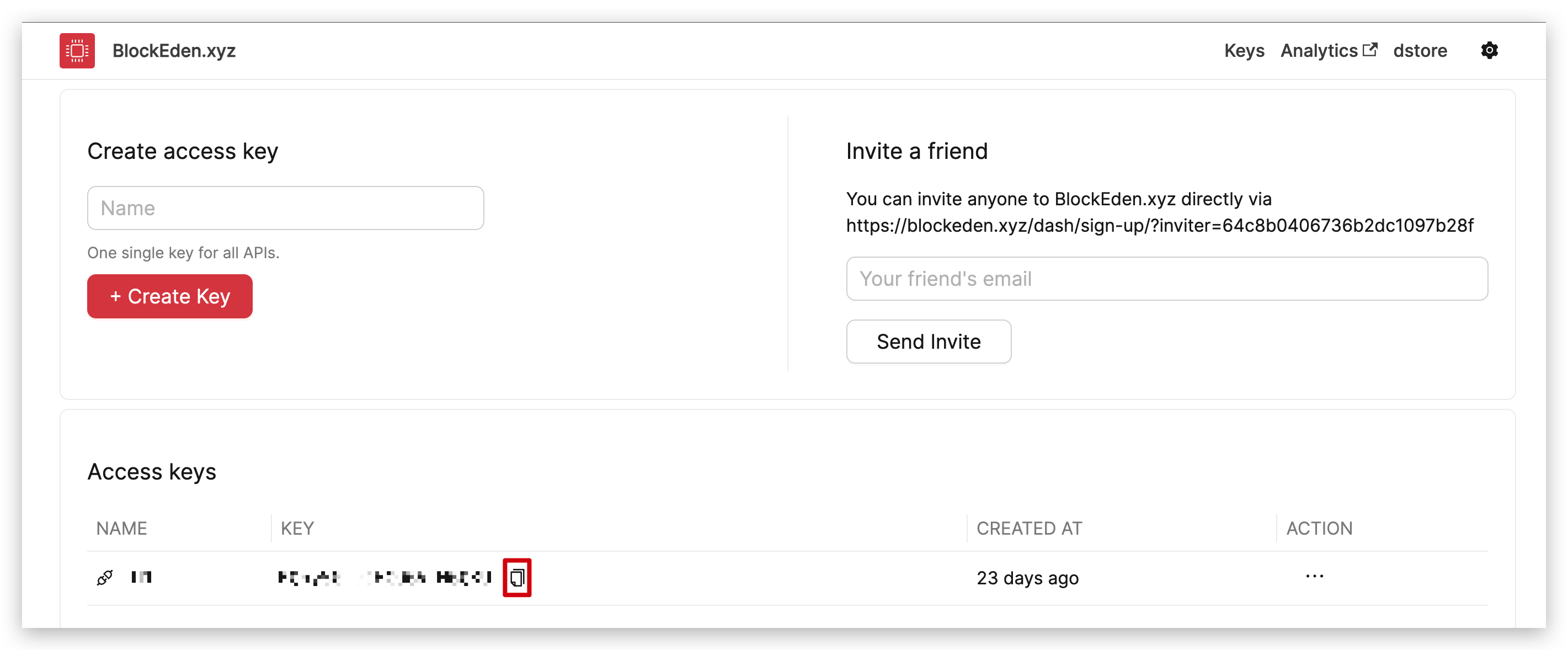

As a node operator, BlockEden.xyz runs Soroban RPC, and then provides commercial standard RPCs to developers on the left. Unlike the official endpoints, our RPCs are equipped with rate limits and API meters tailored to developers’ tiered needs.

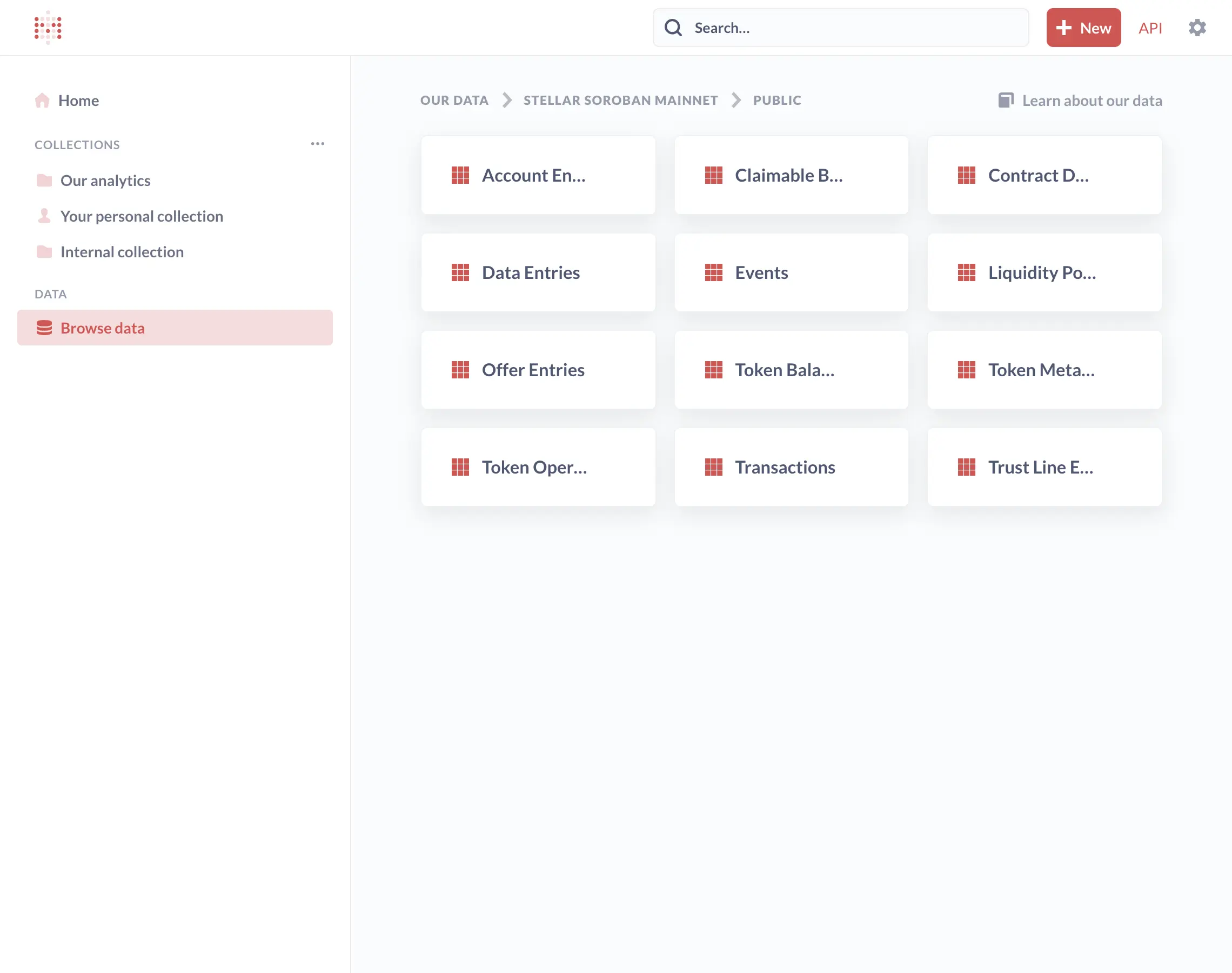

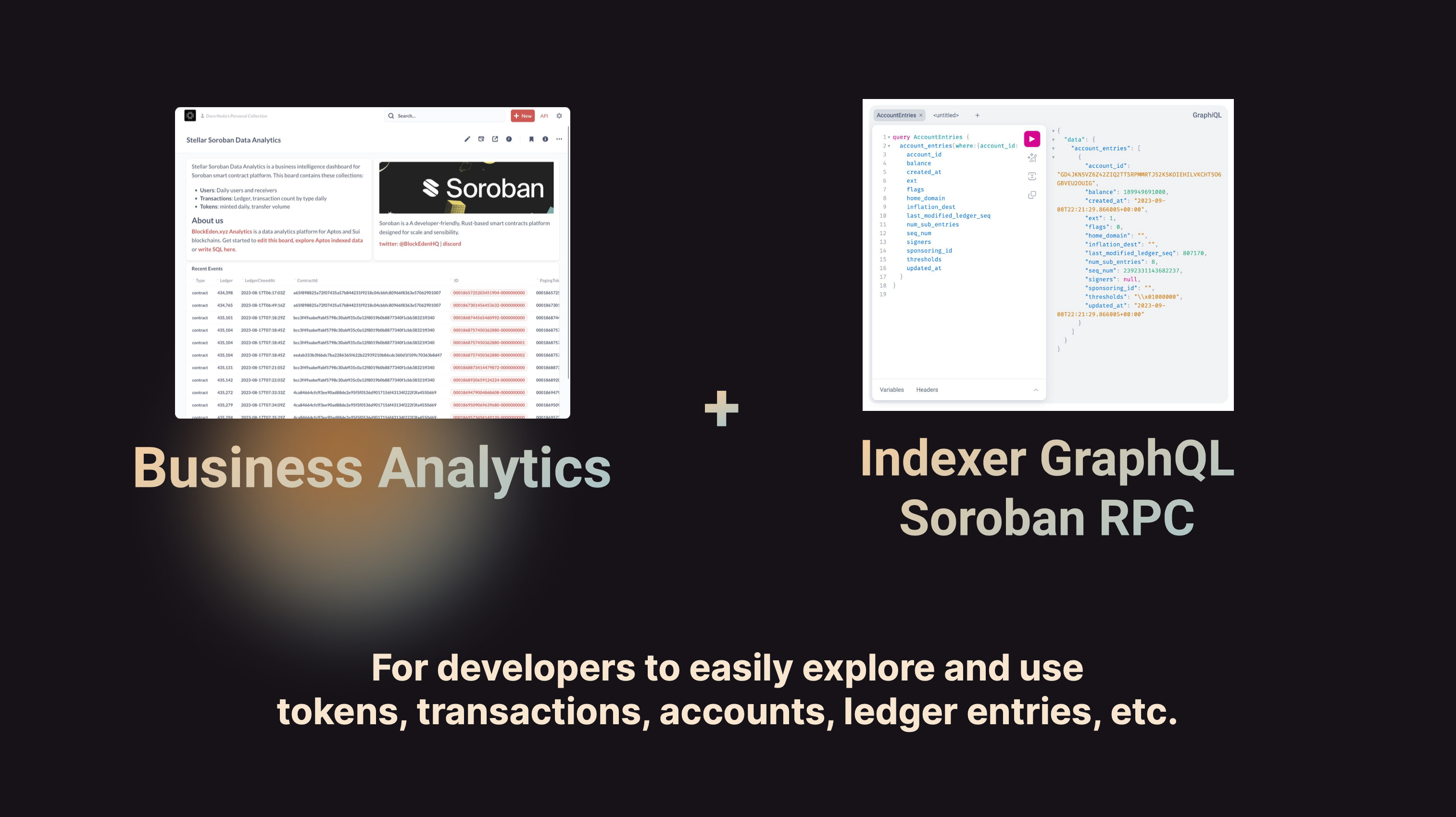

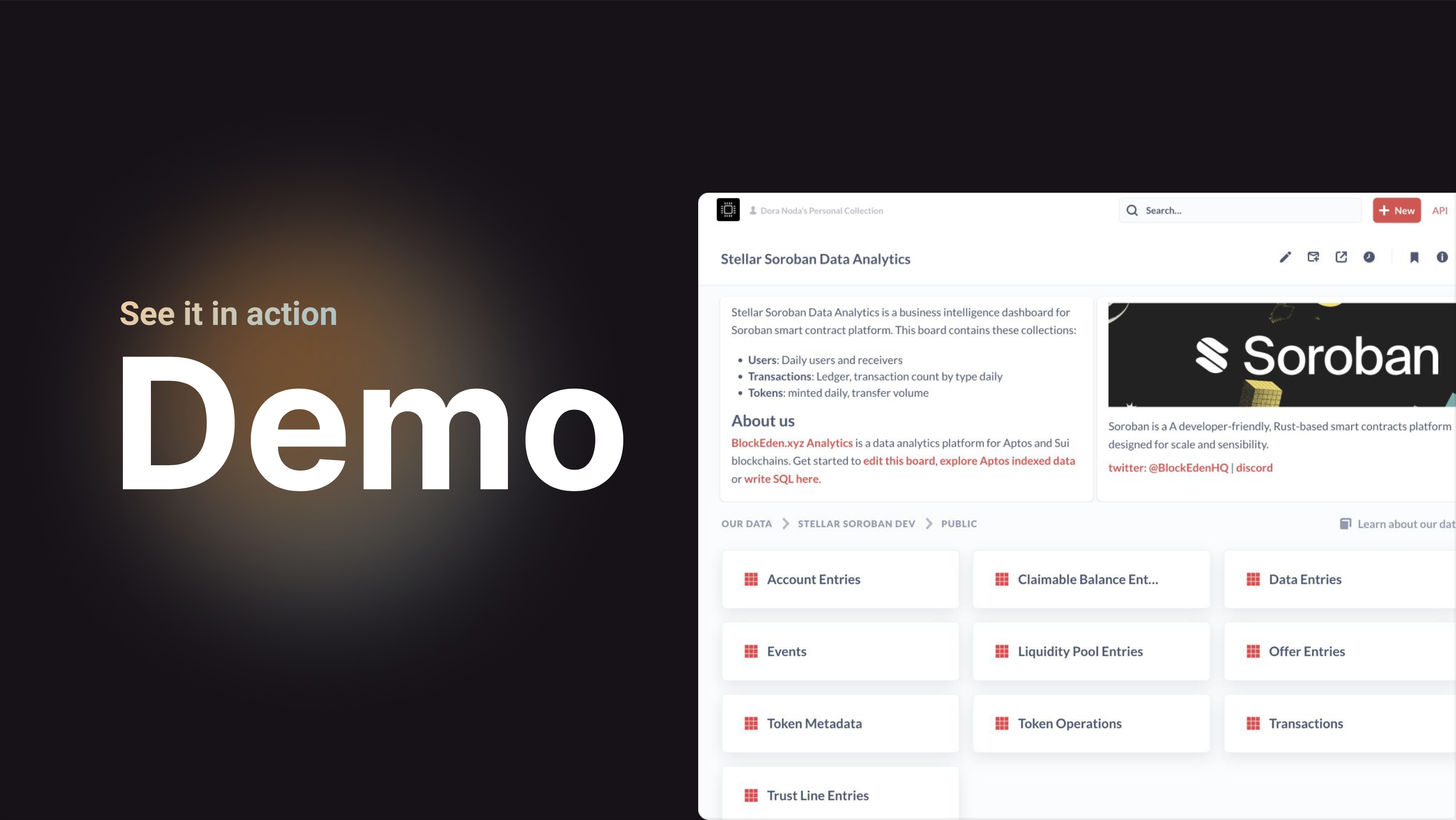

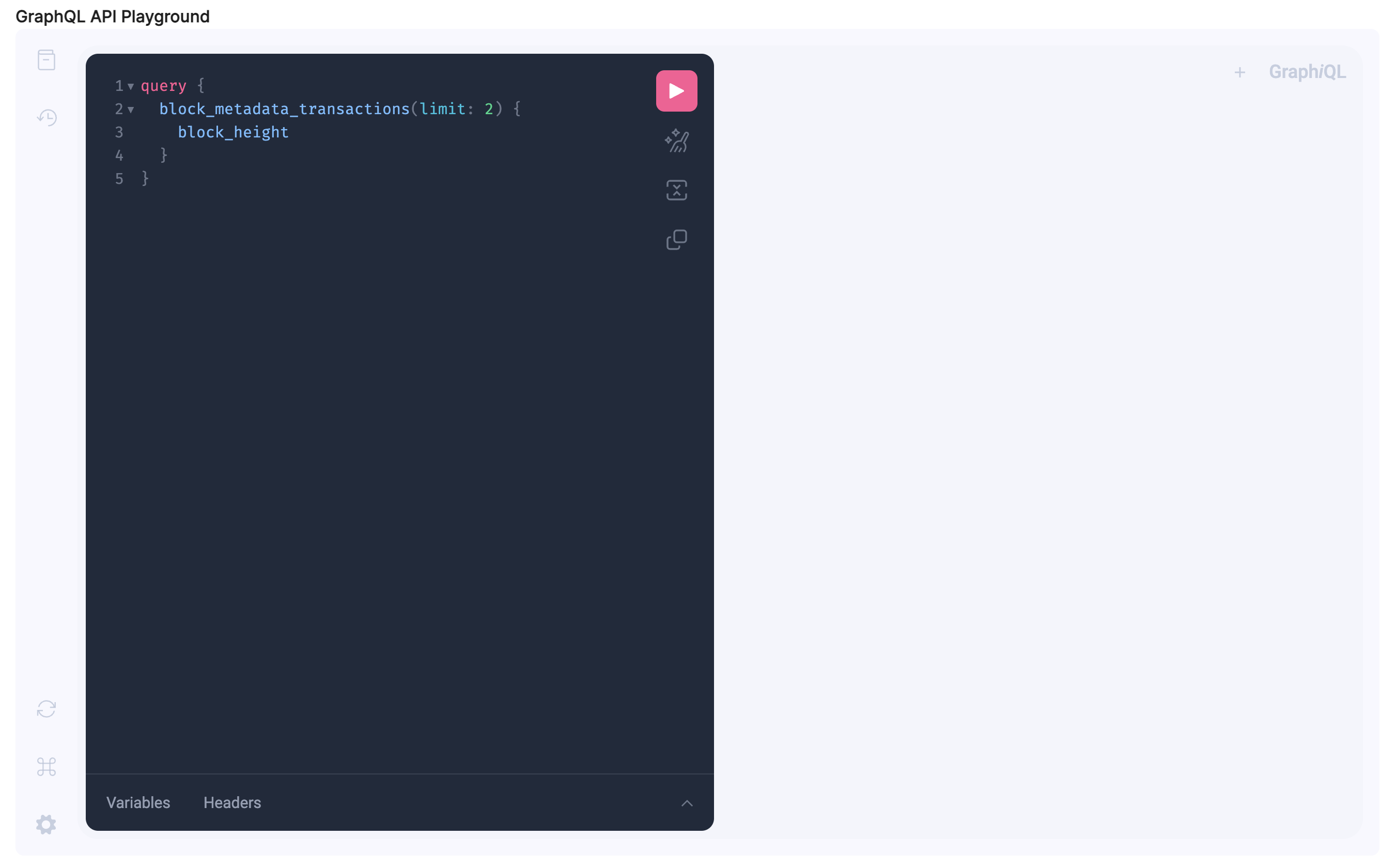

BlockEden.xyz also builds an indexer for contract data, tokens, events, etc. in the Soroban smart contract platform.

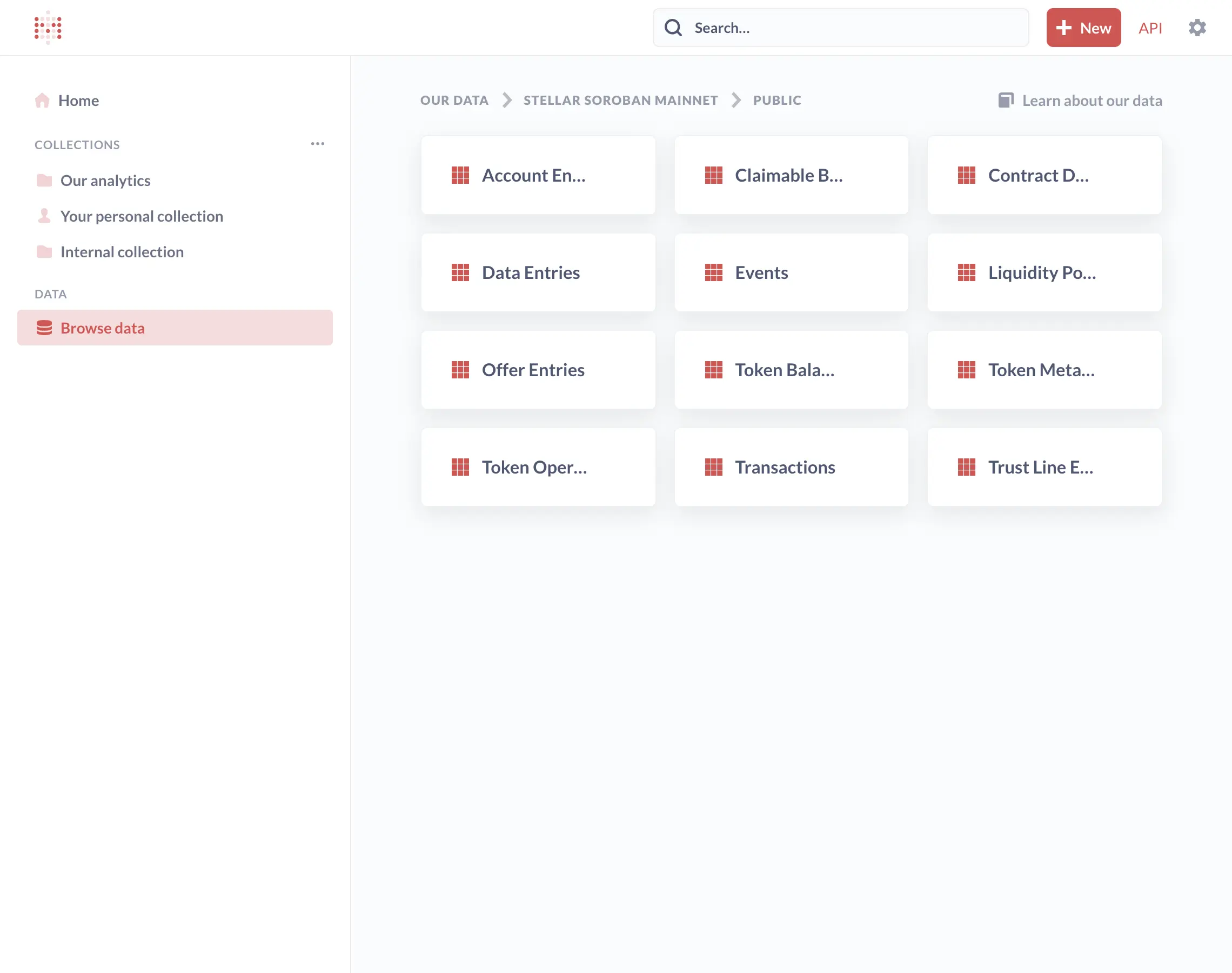

The index data will serve as GraphQL. The exact content of the index data is to be decided, though we will expose at least the developer-facing data models of the Horizon service.

Business Intelligence / Analytics

Soroban RPC

For developer's convenience, we also serve the standard JSON RPC.

Conclusion

In conclusion, as we pave the way towards a new era in blockchain and global finance, our partnership with Stellar represents a significant milestone. Harnessing Stellar's swift, cost-effective transaction capabilities and BlockEden.xyz's high-quality API offerings, we are poised to create a paradigm shift in the way developers engage with the open money network. We hope this work will inspire innovations, trigger advancements, and propel us all towards a more connected and decentralized world. Here's to a future filled with endless possibilities and shared successes.