PayFi's $630B Remittance Play: How Blockchain Is Eating Western Union's Lunch

When Remittix announced its six-layer PayFi Stack integrating Solana and Stellar for cross-border payments, Western Union didn't issue a press release. They launched their own Solana-based stablecoin. The $630 billion global remittance market—dominated by legacy players charging 5-10% fees and taking 3-5 days—faces disruption from Payment Finance protocols that settle in seconds for fractions of a cent. PayFi isn't just cheaper and faster. It's programmable, compliant, and accessible to the 1.4 billion unbanked adults excluded from traditional banking.

The acronym "PayFi" combines "Payment" and "Finance," describing blockchain-based payment infrastructure with programmable features impossible in legacy systems. Unlike stablecoins (static value transfer) or DeFi (speculative finance), PayFi targets real-world payments: remittances, payroll, invoicing, and merchant settlements. The sector's emergence threatens Western Union, MoneyGram, and traditional banks that extract billions annually from migrants sending money home.

The $630B Remittance Market: Ripe for Disruption

Global remittances reached $630 billion annually, with the World Bank projecting growth to $900 billion by 2030. This market is massive, profitable, and inefficient. Average fees hover around 6.25% globally, with some corridors (Sub-Saharan Africa) charging 8-10%. For a Filipina worker in Dubai sending $500 monthly home, $30-50 disappears to fees. Over a year, that's $360-600—meaningful money for families relying on remittances for survival.

Settlement times compound the problem. Traditional wire transfers take 3-5 business days, with weekends and holidays adding delays. Recipients can't access funds immediately, creating liquidity crunches. In emergencies, waiting days for money arrival can mean disaster.

The user experience is archaic. Remittance senders visit physical locations, fill forms, provide IDs, and pay cash. Recipients often travel to collection points. Digital alternatives exist but still route through correspondent banking networks, incurring fees at each hop.

PayFi protocols attack every weakness:

- Fees: Blockchain transactions cost $0.01-0.50, not 5-10%

- Speed: Settlement in seconds, not days

- Accessibility: Smartphone with internet, no bank account required

- Transparency: Fixed fees visible upfront, no hidden charges

- Programmability: Scheduled payments, conditional transfers, smart escrow

The economics are brutal for legacy players. When blockchain alternatives offer 90% cost reduction and instant settlement, the value proposition isn't marginal—it's existential.

Remittix and Huma's PayFi Stack: The Technical Innovation

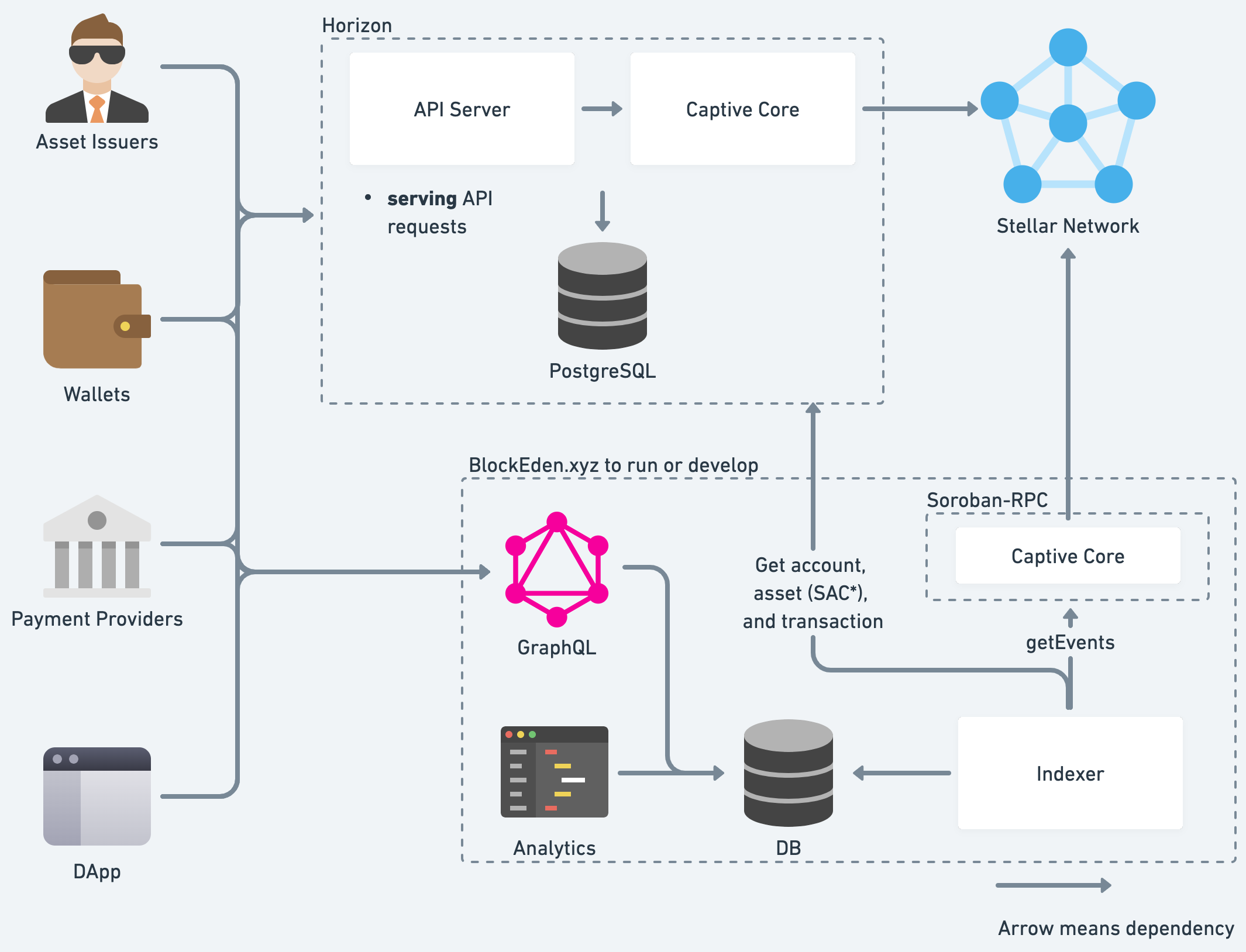

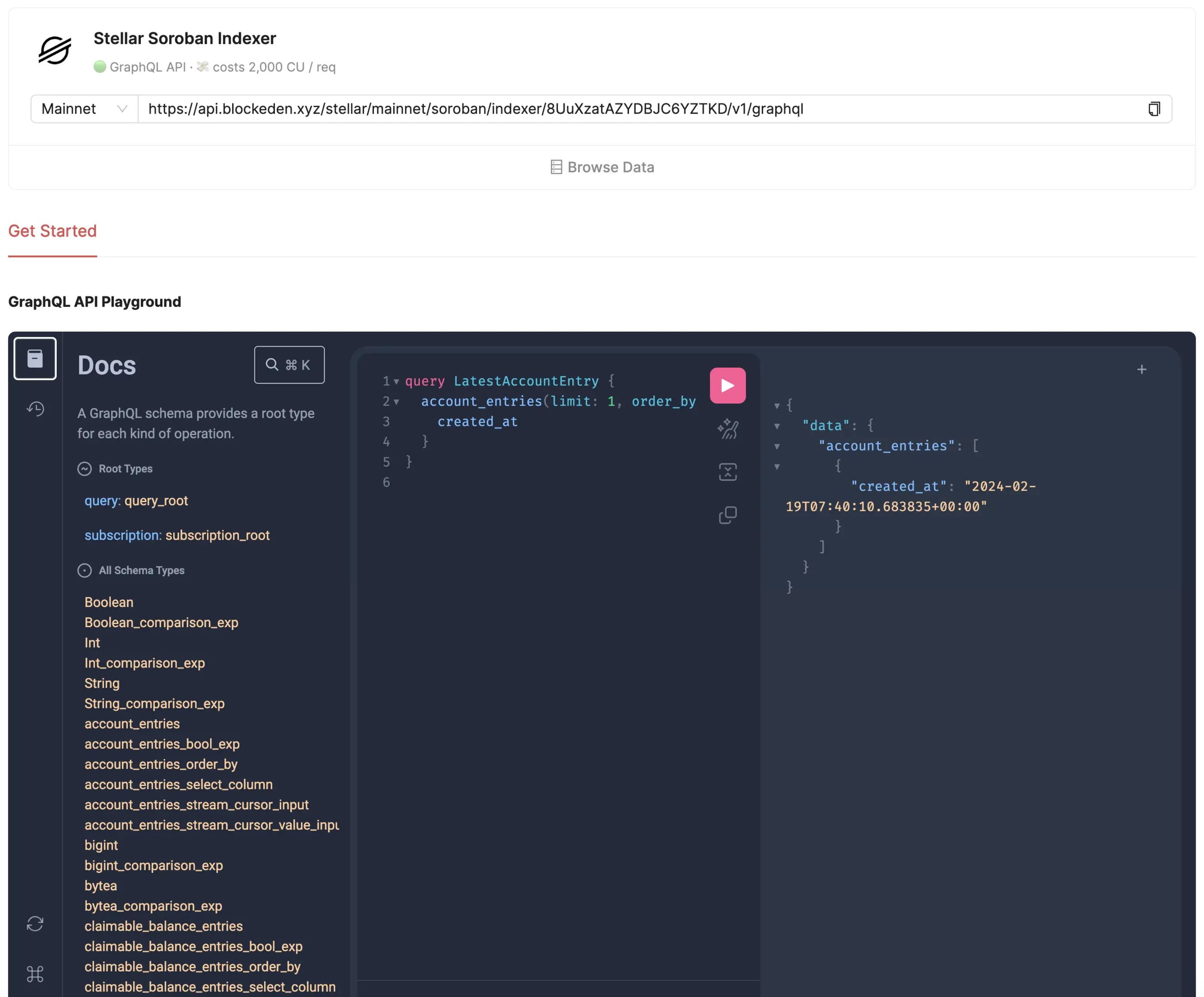

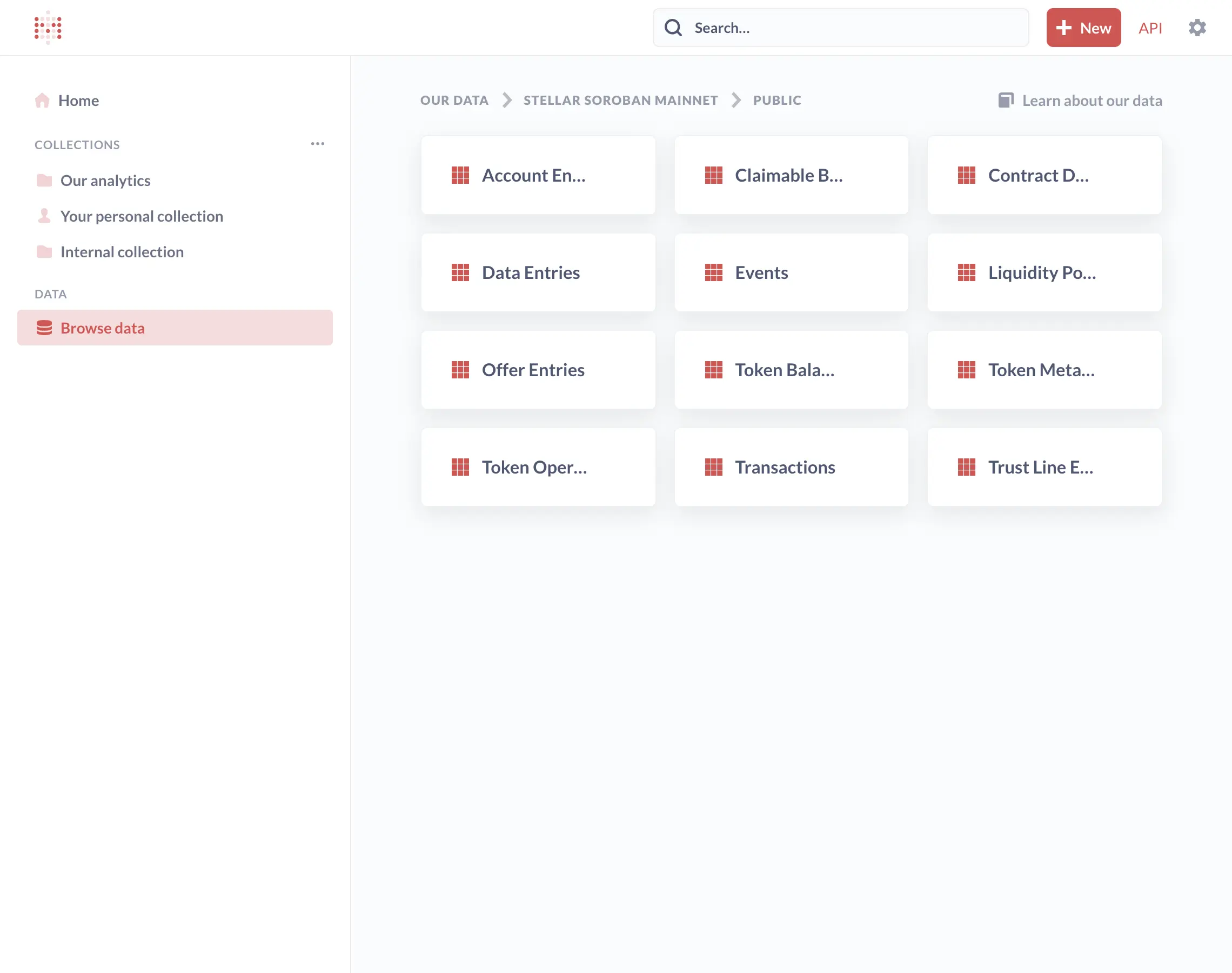

Remittix's six-layer PayFi Stack exemplifies the technical sophistication enabling this disruption:

Layer 1 - Blockchain Settlement: Integration with Solana (speed) and Stellar (remittance-optimized) provides redundant, high-performance settlement rails. Transactions finalize in 2-5 seconds with sub-cent costs.

Layer 2 - Stablecoin Infrastructure: USDC, USDT, and native stablecoins provide dollar-denominated value transfer without volatility. Recipients receive predictable amounts, eliminating crypto price risk.

Layer 3 - Fiat On/Off Ramps: Integration with local payment providers enables cash-in and cash-out in 180+ countries. Users send fiat, blockchain handles middle infrastructure, recipients get local currency.

Layer 4 - Compliance Layer: KYC/AML checks, transaction monitoring, sanctions screening, and reporting ensure regulatory compliance across jurisdictions. This layer is critical—without it, financial institutions won't touch the platform.

Layer 5 - AI-Driven Risk Management: Machine learning models detect fraud, assess counterparty risk, and optimize routing. This intelligence reduces chargebacks and improves reliability.

Layer 6 - API Integration: RESTful APIs enable businesses, fintechs, and neobanks to embed PayFi infrastructure without building from scratch. This B2B2C model scales adoption faster than direct-to-consumer.

The stack isn't novel in individual components—stablecoins, blockchain settlement, and compliance tools all exist. The innovation is integration: combining pieces into a cohesive system that works across borders, currencies, and regulatory regimes at consumer scale.

Huma Finance complements this with institutional-grade credit and payment infrastructure. Their protocol enables businesses to access working capital, manage payables, and optimize cash flow using blockchain rails. Combined, these systems create end-to-end PayFi infrastructure from consumer remittances to enterprise payments.

Western Union's Response: If You Can't Beat Them, Join Them

Western Union's announcement of USDPT stablecoin on Solana validates the PayFi thesis. A 175-year-old company with 500,000 agent locations globally doesn't pivot to blockchain because it's trendy. It pivots because blockchain is cheaper, faster, and better.

Western Union processes $150 billion annually for 150 million customers across 200+ countries. The company compared alternatives before selecting Solana, citing its ability to handle thousands of transactions per second at fractions of a cent. Traditional wire infrastructure costs dollars per transaction; Solana costs $0.001.

The economic reality is stark: Western Union's fee revenue—their core business model—is unsustainable when blockchain alternatives exist. The company faces a classic innovator's dilemma: cannibalize fee revenue by adopting blockchain, or watch startups do it instead. They chose cannibalization.

USDPT targets the same remittance corridors PayFi protocols attack. By issuing a stablecoin with instant settlement and low fees, Western Union aims to retain customers by matching upstart economics while leveraging existing distribution networks. The 500,000 agent locations become cash-in/cash-out points for blockchain payments—a hybrid model blending legacy physical presence with modern blockchain rails.

However, Western Union's structural costs remain. Maintaining agent networks, compliance infrastructure, and legacy IT systems creates overhead. Even with blockchain efficiency, Western Union can't achieve PayFi protocols' unit economics. The incumbents

' response validates the disruption but doesn't eliminate the threat.

The Unbanked Opportunity: 1.4 Billion Potential Users

The World Bank estimates 1.4 billion adults globally lack bank accounts. This population isn't uniformly poor—many have smartphones and internet but lack access to formal banking due to documentation requirements, minimum balances, or geographic isolation.

PayFi protocols serve this market naturally. A smartphone with internet suffices. No credit checks. No minimum balances. No physical branches. Blockchain provides what banks couldn't: financial inclusion at scale.

The use cases extend beyond remittances:

Gig economy payments: Uber drivers, freelancers, and remote workers receive payments instantly in stablecoins, avoiding predatory check-cashing services or waiting days for direct deposits.

Merchant settlements: Small businesses accept crypto payments and receive stablecoin settlement, bypassing expensive merchant service fees.

Microfinance: Lending protocols provide small loans to entrepreneurs without traditional credit scores, using on-chain transaction history as creditworthiness.

Emergency transfers: Families send money instantly during crises, eliminating waiting periods that worsen emergencies.

The addressable market isn't just $630 billion in existing remittances—it's the expansion of financial services to populations excluded from traditional banking. This could add hundreds of billions in payment volume as the unbanked access basic financial services.

AI-Driven Compliance: Solving the Regulatory Bottleneck

Regulatory compliance killed many early crypto payment attempts. Governments rightly demand KYC/AML controls to prevent money laundering and terrorism financing. Early blockchain payment systems lacked these controls, limiting them to gray markets.

Modern PayFi protocols embed compliance from inception. AI-driven compliance tools provide:

Real-time KYC: Identity verification using government databases, biometrics, and social signals. Completes in minutes, not days.

Transaction monitoring: Machine learning flags suspicious patterns—structuring, circular flows, sanctioned entities—automatically.

Sanctions screening: Every transaction checks against OFAC, EU, and international sanctions lists in real-time.

Regulatory reporting: Automated generation of reports required by local regulators, reducing compliance costs.

Risk scoring: AI assesses counterparty risk, predicting fraud before it occurs.

This compliance infrastructure makes PayFi acceptable to regulated financial institutions. Banks and fintechs can integrate PayFi rails with confidence that regulatory requirements are met. Without this layer, institutional adoption stalls.

The AI component isn't just automation—it's intelligence. Traditional compliance relies on rules engines (if X, then flag). AI learns patterns from millions of transactions, detecting fraud schemes rules-engines miss. This improves accuracy and reduces false positives that frustrate users.

The Competitive Landscape: PayFi Protocols vs. Traditional Fintechs

PayFi protocols compete not just with Western Union but also with fintechs like Wise, Revolut, and Remitly. These digital-first companies offer better experiences than legacy providers but still rely on correspondent banking for cross-border transfers.

The difference: fintechs are marginally better; PayFi is structurally superior. Wise charges 0.5-1.5% for transfers, still using SWIFT rails in the background. PayFi charges 0.01-0.1% because blockchain eliminates intermediaries. Wise takes hours to days; PayFi takes seconds because settlement is on-chain.

However, fintechs have advantages:

Distribution: Wise has 16 million users. PayFi protocols are starting from zero.

Regulatory approval: Fintechs hold money transmitter licenses in dozens of jurisdictions. PayFi protocols are navigating regulatory approval.

User trust: Consumers trust established brands over anonymous protocols.

Fiat integration: Fintechs have deep banking relationships for fiat on/off ramps. PayFi protocols are building this infrastructure.

The likely outcome: convergence. Fintechs will integrate Pay Fi protocols as backend infrastructure, similar to how they use SWIFT today. Users continue using Wise or Revolut interfaces, but transactions settle on Solana or Stellar in the background. This hybrid model captures PayFi's cost advantages while leveraging fintechs' distribution.